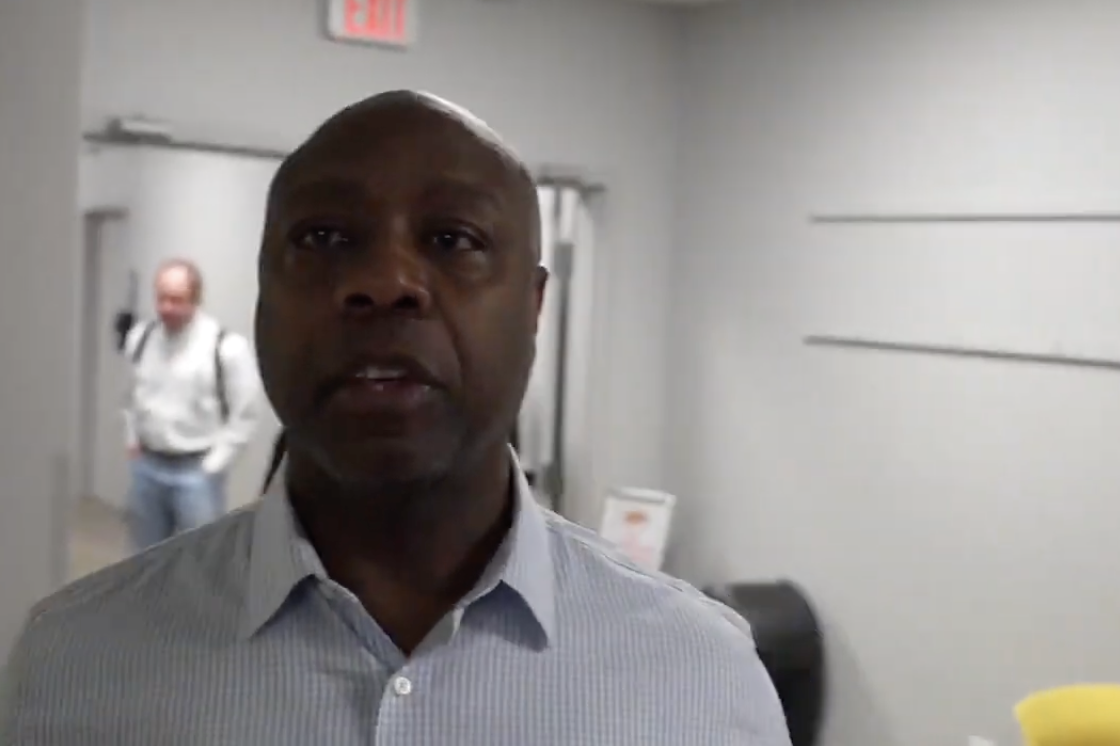

Tim Scott On Abortion

Scott Opposed Roe v. Wade

SCOTT PRAISED THE SUPREME COURT’S DECISION TO OVERTURN THE RIGHT TO SAFE AND LEGAL ABORTION

ABC News 4: “Scott Is In Full Support Of The Supreme Court’s Decision To Overturn Roe v. Wade.” According to ABC News 4, “Scott is in full support of the Supreme Court’s decision to overturn Roe v. Wade. ‘It’s a really simple question: It’s ‘should we chose life when we can?’ The answer is, of course we should.’” [ABC News 4, 6/27/22]

Scott Signed On To An Amicus Brief Urging The Court To Overturn Roe V. Wade

Scott Signed On To Friend Of Court Brief Urging The Supreme Court To Reconsider, And Maybe Overrule, Roe. According to CNN, “More than 200 members of Congress are urging the Supreme Court to reconsider – if not overrule – the landmark 1973 Roe v. Wade decision, which legalized abortion nationwide. Thirty-nine Republican senators and 168 members of the House of Representatives, almost all of them Republicans, signed a so-called ‘friend of the court’ brief filed on Thursday by the national anti-abortion group Americans United for Life in connection with a challenge to a Louisiana abortion access law due to be heard in March. The signers include Sens. Ted Cruz of Texas, Chuck Grassley of Iowa, Mike Lee and Mitt Romney of Utah, and Tim Scott of South Carolina as well as Reps. Steve Scalise of Louisiana, Liz Cheney of Wyoming and Steve Chabot of Ohio. […] The brief argues that ‘Roe’s jurisprudence has been haphazard from the beginning.’ The decision ‘remains a radically unsettled precedent’ that ‘has been substantially undermined by subsequent authority,’ the group continues, adding that court rulings since Roe ‘clearly did not settle the abortion issue.’ The group urges the justices to ‘reconsider those precedents.’” [CNN, 1/2/20]

Scott Supported A Federal Abortion Ban

Scott Campaigned On Signing A Federal Abortion Ban As President

AUDIO: Scott Said, “Our Immediate Priority Should Be Passing A 15-Week Limit On Abortion.” According to a Scott Radio Ad via YouTube, “As President, I will sign the most pro-life legislation that reaches my desk. Our immediate priority should be passing a national 15-week limit on abortion while we support Republican-led States that do even more to protect life.” [Scott Radio Ad via YouTube, 6/29/23]

VIDEO: Scott: “We Have To Have A Federal Limit On” Abortion. According to a video from Scott’s interview with WMUR, “SCOTT: I think states have to solve that problem on their own. The big problem we see today is that our Democrats want to make this a federal issue of having abortions into the third trimester. That is something that puts us in the company with China and North Korea. We cannot go there. So, we have to have a federal limit on how far we can go, and that is something that we have to discuss.” [Twitter, Video, @AdamSextonWMUR, 4/13/23]

Scott Said That He Would Start At A 15-Week Abortion Ban And Try To Get It More Conservative. According to KCCI, “When asked about the role of the federal government in abortion, Scott proposed a 15-week abortion ban. ‘If I was president of the United States, I would start the conversation with a limit of 15 weeks and then try my best to win the hearts and minds of Americans, to get it any more conservative,’ Scott said.” [KCCI, 6/14/23]

Scott Promised To Support Extreme Anti-Abortion Legislation As President

Scott Vowed That He Would Sign “The Most Conservative, Pro-Life Legislation” As President. According to NBC News, “Sen. Tim Scott, R-S.C., promised in an interview with NBC News on Friday that if elected president, he would support the ‘most conservative pro-life legislation’ that Congress sends him, leaving open the possibility that it could be as early as six weeks but not committing to a specific time frame. ‘If I were president of the United States, I would literally sign the most conservative, pro-life legislation that they can get through Congress,’ Scott said. ‘I’m not going to talk about six or five or seven or 10,’ he added, pressed by NBC News about what the federal cutoff should be. ‘I’m just saying that whatever the most conservative legislation is that can come through Congress.’” [NBC News, 4/14/23]

Scott On Social Security And Medicare

Scott Voted To Cut Medicare

2017: Scott Voted To Cut $7.6 Trillion In Medicare

2017: Scott Voted For An Amendment That Would Have Reduced Deficit Levels, Resulting In What Democrats Claimed Would Be “Massive Cuts To Medicare.” In January 2017, Tim Scott voted for an amendment that would have, according to Congressional Quarterly, “gradually reduce[d] the authorized level of the budget deficit until a budget surplus is required in Fiscal 2024.” In addition, also according to Congressional Quarterly, “But fiscal conservatives, led by Sen. Rand Paul, R-Ky., pushed for an alternative budget that promised to balance the budget within five years. Paul said his amendment would eliminate annual deficits by freezing overall spending levels for the whole budget, except Social Security and the U.S. Postal Service. ‘You’ll be voting for fiscal conservatism that says, ‘Enough’s enough,’ ‘Paul told his colleagues in urging support for his measure. But Democrats said Paul’s budget would require ‘massive cuts’ to Medicare, Medicaid and other social programs. Freezing spending would amount to cutting $7.6 trillion over a decade from current plans, according to a calculation given CQ by the nonpartisan Committee for a Responsible Federal Budget.” The underlying legislation was an FY 2017 budget resolution designed to begin the process of repealing the Affordable Care Act. The vote was on the amendment. The Senate rejected the amendment by a vote of 14 to 83. [Senate Vote 3, 1/9/17; Congressional Quarterly, 1/9/17; Congressional Quarterly, 1/10/17; Congressional Actions, S. Amdt. 1; Congressional Actions, S. Con. Res. 3]

Scott Voted To Cut $430 Billion In Medicare

2015: Scott Voted To Make $430 Billion In Unexplained Cuts To Medicare, As Part Of The FY 2016 Conference Report Budget Resolution. In May 2015, Scott voted for the FY 2016 conference report budget resolution which, according to the Congressional Conference Report, “The agreement proposes the same amount of Medicare savings reflected in the Senate-passed fiscal year 2016 budget as a target to extend the life of the Hospital Insurance trust fund and tasks the committees of jurisdiction in the House and Senate with determining the specific Medicare reforms needed to bring spending levels under current law in line with the budget.” According to Bloomberg, the Senate’s original budget, “avoided a plan to partially privatize Medicare that the U.S. House of Representatives embraced in its budget [and] instead call[ed] for $430 billion in spending cuts without explaining where they would be made.” The vote was on the Conference Report; the Conference Report, which also passed the House, was passed by a vote of 51 to 48. [Senate Vote 171, 5/5/15; Conference Report, 4/29/15; Bloomberg, 3/27/15; Congressional Actions, S. Con. Res. 11]

Scott Voted To Raise The Eligibility Age For Medicare

Scott Supported Raising The Medicare Eligibility Age, Which Would Have Led To Higher Costs And More Uninsured Seniors

2013: Scott Voted To Raise The Medicare Eligibility Age To 70 Over 20 Years, As Part Of Senator Rand Paul’s Proposed Budget. In March 2013, Tim Scott voted for raising the Medicare eligibility age to 70 over 20 years, as part of Sen. Rand Paul’s (R-KY) proposed budget resolution covering fiscal years 2013 to 2023. According to the Congressional Record, Paul’s budget resolution contained a policy statement that future “legislation must increase the age of eligibility gradually over 20 years, increasing the age from 65 to 70, resulting in a 3-month increase per year.” The vote was on an amendment to the Senate budget resolution replacing the entire budget with Paul’s proposed budget; the Senate rejected the amendment by a vote of 18 to 81. [Senate Vote 69, 3/22/13; Congressional Record, 3/21/13; Congressional Actions, S. Amdt. 263; Congressional Actions, S. Con. Res. 8]

Scott Supported Raising The Age Of Eligibility For Social Security

Scott Supported Raising The Social Security Eligibility Age

Scott Proposed Raising The Age Of Social Security Eligibility To 69 Or 70. According to Grenville News, “U.S. Sen. Tim Scott of South Carolina said Wednesday he favors eventually raising the Social Security retirement age to 69 or 70 to make sure the program remains solvent. Scott, in an interview with editors and reporters at GreenvilleOnline.com, said gradually adjusting the full retirement age wouldn’t apply to anyone now 55 or older. Adjusting the retirement age would give younger residents, such as himself, time to plan for retirement, said Scott, who is 47. ‘If you give people enough time, like a guy in his 40s, to retire at 69, that gives me 20 to 22 years to get to a place of retiring,’ Scott said.” [Greenville News, 3/28/13]

Tim Scott’s Opportunity Zones Failed To Help Americans

Opportunity Zones Were One Of Scott’s Top Priorities

Scott Long Fought For Opportunity Zones

2023: Scott On Opportunity Zones: “I’ll Never Stop Fighting To Build On The Incredible Work This Program Has Done.” According to a press release from Senator Scott, “‘Opportunity Zones embody the good work leaders can do for communities across the country when government gets out of the way and allows us to work together,’ said Senator Scott. ‘Investments in these underserved areas make a huge impact on communities – to the tune of billions of dollars. I’ll never stop fighting to build on the incredible work this program has done and help create a better future for all Americans.’” [Press Release, Tim Scott, 3/22/23]

2022: Scott Introduced Legislation To Extend Opportunity Zones Past Their Expiration. According to Bloomberg Tax, “A bipartisan group in Congress led by Sens. Cory Booker (D-N.J) and Tim Scott (R-S.C.) introduced a bill that would extend the federal program past its 2026 expiration as well as restore and expand federal reporting requirements that were part of an earlier version of the program, but stripped from the final version that became law.” [Bloomberg Tax, 10/30/22]

2021: Scott Identified Opportunity Zones As A Part Of His Opportunity Agenda. According to Scott’s opinion in Deseret News, “I created my Opportunity Agenda for this reason — to help Americans who grew up in similar situations as I did and are living without hope for the future. Within my Opportunity Agenda are Opportunity Zones, distressed areas designated by states to allow us to foster entrepreneurship and job creation in neighborhoods that need it the most.” [Deseret News, Tim Scott, Opinion, 1/11/21]

Scott Lobbied Trump To Support Opportunity Zones

Scott Said He Pitched Opportunity Zones To Trump. According to an excerpt from Scott’s book published in Fox News, “For those twenty minutes President Trump didn’t say a word. He just listened. […] I began to paint the picture of a plan I’d been dreaming of that would bring serious private investment into lower-income neighborhoods, what I had dubbed ‘opportunity zones.’ While the president had listened intently the entire time, he became excited when our conversation came to the subject of rebuilding communities. ‘Tim, I understand incentives better than anyone. Listen, I’m a dealmaker. It’s what I’m great at. I think this idea doesn’t just help one group; it moves the economy of the entire nation forward. Right? This is what we need. Something that creates success in America. […] From that day forward, I was able to utilize the power of the president of the United States and his influence to make opportunity zones a reality. It came to fruition through the 2017 tax reform bill. To date, more than $75 billion of private equity has been committed to these neighborhoods throughout the country, and that number is ever expanding. This is one of the things I am most proud of, and it would not have been possible without the aid of President Trump.” [Excerpt From Scott’s Book Published In Fox News, 8/4/22]

Scott Met With Trump At A White House Meeting After Charlottesville And Pitched Opportunity Zones. According to CNN, “Scott, the first black senator elected in the South since Reconstruction, met with Trump for 40 minutes at the White House last year after the President faced bipartisan criticism for drawing equivalence between white supremacists protesting the removal of a Confederate monument in Charlottesville, Virginia, and counter protesters. […] The outcome of their conversation, Scott said, was Trump’s support of the senator’s ‘opportunity zone’ legislation, which made it into the GOP tax overhaul and uses tax incentives to encourage businesses to invest in low-income communities.” [CNN, 7/2/18]

Opportunity Zones Benefitted Wealthy People

Opportunity Zones Functioned As A Tax Break For Private Investors

CBPP On Opportunity Zones: “Tax Breaks Will Directly Benefit Wealthy Private Investors.” According to the Center On Budget And Policy Priorities, “Because taxpayers must have unrealized capital gains to invest in an opportunity zone, and capital gains are heavily concentrated among the wealthy, the tax break will directly benefit wealthy private investors. Local residents of opportunity zones will benefit only to the extent that the tax break encourages new investments (not those that would have occurred anyway); creates jobs for residents; spurs the development of new, affordable housing; or creates broader economic improvements that reach local residents.” [Center On Budget And Policy Priorities, 1/11/19]

Center For American Progress: Opportunity Zone Tax Provided Tax Benefits To Wealthy Investors. According to the Center For American Progress, “Important new research by economists Patrick Kennedy and Harrison Wheeler adds to a growing volume of evidence that opportunity zone tax breaks, created as part of the 2017 Tax Cuts and Jobs Act (TCJA), are costly and poorly targeted and do little to create jobs or improve conditions in poor communities. Instead, opportunity zones provide massive tax benefits to wealthy investors while subsidizing investment in few communities with relatively higher incomes, home values, and educational attainment as well as stronger income and population growth.” [Center For American Progress, 6/16/22]

Wealthy Investors Took Advantage Of Opportunity Zones Through Real Estate

Opportunity Zones Investment Was Largely Concentrated In Real Estate For Wealthy Donors. According to the Center For American Progress, “Opportunity zone investment is overwhelmingly concentrated in real estate, construction, and finance. Real estate alone received more than half of opportunity zone dollars. […] Rather than directly investing in property or business assets, the vast major of opportunity zone investments were structured as partnerships to allow investors to claim the special deduction for pass-through entities that was also created by the 2017 TCJA.” [Center For American Progress, 6/16/22]

Investment Into Opportunity Zones Was Spent On High-End Apartments And Hotels

New York Times: Opportunity Zone Investments Were Spent On High-End Apartments And Hotels And Buildings With Low Job Creation. According to the New York Times, “Instead, billions of untaxed investment profits are beginning to pour into high-end apartment buildings and hotels, storage facilities that employ only a handful of workers, and student housing in bustling college towns, among other projects. Many of the projects that will enjoy special tax status were underway long before the opportunity-zone provision was enacted. Financial institutions are boasting about the tax savings that await those who invest in real estate in affluent neighborhoods.” [New York Times, 8/31/19]

Opportunity Zone Investment Made The Top One Percent Wealthier

Center For American Progress: Opportunity Zones Made The Top One Percent Wealthier. According to the Center For American Progress, “The average household income of opportunity fund investors—the direct beneficiaries of zone tax breaks—placed them well into the top 1 percent of the income distribution, at $4.8 million in 2019, compared with $117,000 for the population as a whole. This is not surprising given the fact that capital gains income is highly skewed toward the wealthiest households, as detailed in prior research by the Center for American Progress. These are the households that stand to benefit from the ability to shelter gains provided by opportunity zone tax breaks.” [Center For American Progress, 6/16/22]

Opportunity Zone Investment Failed To Support Manufacturing

Opportunity Zones Failed To Adequately Invest In Manufacturing. According to the Center For American Progress, “Only 1 percent of the firms that received opportunity zone funds were in manufacturing.” [Center For American Progress, 6/16/22]

Opportunity Zones Did Not Benefit Average Americans And Their Communities

Higher-Income Areas Received Opportunity Zone Investment

Opportunity Zone Designation Allowed Investments To Go To Higher-Income Areas. According to the Center On Budget And Policy Priorities, “Governors, who have now completed the selection process, had to choose most of these zones from localities that qualify as ‘low-income communities,’ meaning that they have either a poverty rate of at least 20 percent or a median income that’s no greater than 80 percent of the median income in their metropolitan area. This definition of ‘low-income community’ is broad enough to include some areas that are not truly distressed, such as areas adjacent to some elite colleges — for example, the University of Virginia and the University of California at Berkeley, where a large concentration of students skews the income data. Furthermore, the law lets governors designate a subset of areas that are adjacent to a low-income community and have a median income of no more than 125 percent of the median income of the adjacent low-income community. Thus, they could designate as opportunity zones a number of areas that many would not consider ‘distressed’ — including Long Island City, where Amazon is moving one of its new headquarters.” [Center On Budget And Policy Priorities, 1/11/19]

Center For American Progress: Higher-Income Areas Have Taken Advantage Of Opportunity Zones. According to the Center For American Progress, “While the tax breaks were ostensibly intended to direct capital to neighborhoods most in need, the large number of zones—8,764 census tracts designated in 2018, home to about 10 percent of the U.S. population—along with the ability to classify higher-income areas adjacent to poor neighborhoods ultimately undermined the program’s focus.” [Center For American Progress, 6/16/22]

Opportunity Zones Did Not Help Communities In Need

Opportunity Zone Investment Did Not Significantly Improve Economic Outcomes For Areas In Need. According to the Center For American Progress, “A comparison of changes in housing prices in opportunity zones and closely matched areas that were not selected as zones found negligible evidence of an increase after zone designation. The authors of the study state that their findings indicate that ‘buyers do not believe that Opportunity Zone status will generate a significant change in the economic fortunes of the neighborhood.” [Center For American Progress, 6/16/22]

Job Postings In Opportunity Zones Were Not Higher Than Those In Non Opportunity Zones. According to the Center For American Progress, “A comparison of job postings—which the researchers suggest can be a ‘leading indicator’ of job growth—in opportunity zones and ZIP codes eligible, but not selected, for zone designation found no increase in postings in designated zones. Specifically, the authors of the study stated finding ‘no evidence of zip codes with OZs having more job postings than comparable non-OZ zip codes over the whole sample. Similarly, we found find no evidence of an effect for OZs with confirmed investment. Neither do we find an effect in construction and real estate industries, the industries in which we should expect a large number of projects taking advantage of the program.’” [Center For American Progress, 6/16/22]

Opportunity Zone Investment Neglected Communities In Real Need

A Community Development Organizer Quoted In The New York Times Claimed That Opportunity Zones Are Not Doing Good For Communities In Need. According to the New York Times, “But leaders of groups that work in cities and rural areas to combat poverty say they are disappointed with how it is playing out so far. ‘Capital is going to flow to the lowest-risk, highest-return environment,’ said Aaron T. Seybert, the social investment officer at the Kresge Foundation, a community-development group in Troy, Mich., that supported the opportunity-zone effort. ‘Perhaps 95 percent of this is doing no good for people we care about.’” [New York Times, 8/31/19]

Center For American Progress: Opportunity Zones Benefited Projects That Were Of “Little Use To Community Residents.” According to the Center For American Progress, ‘“Opportunity zones’ singular focus on reducing taxes owed on capital gains structurally favors projects that generate high returns, rather than the greatest social impact. For example, a luxury apartment building could be a more lucrative investment generating larger tax benefits than low-income housing that fulfills a community’s greater need. Similarly, zone investors—who receive the tax breaks—are typically passive investors who use the opportunity fund structure to shelter gains earned both within and outside zones. The structure of the tax breaks make them of little use to community residents who lack a stock of capital gains but who have a long-term commitment to the types of investments that create a thriving community. Other flaws in the structure of the incentives allow investors to claim tax breaks for opportunity funds that invest in other funds rather than directly in a zone. A 2022 report by the Treasury’s Inspector General for Tax Administration found that slightly more than 1 out of 20, or 6.4 percent, of the opportunity funds it examined had made such circular investments, totaling $1.3 billion.” [Center For American Progress, 6/16/22]

Opportunity Zones Have Not Shown A Significant Impact

Center For American Progress: Research Shows That Opportunity Zones Benefitted Areas Already Seeing Development, Therefore Having Little To No Impact. According to the Center For American Progress, “Taken as a whole, research to date suggests that opportunity zone tax breaks have largely benefited areas already experiencing development, projects that would have occurred in the absence of an incentive, and/or projects—such as self-storage facilities and bitcoin mining facilities—that do little to create employment and economic activity in surrounding communities.” [Center For American Progress, 6/16/22]

Tim Scott On the Record

Here are some of Scott' most extreme statements straight from him...