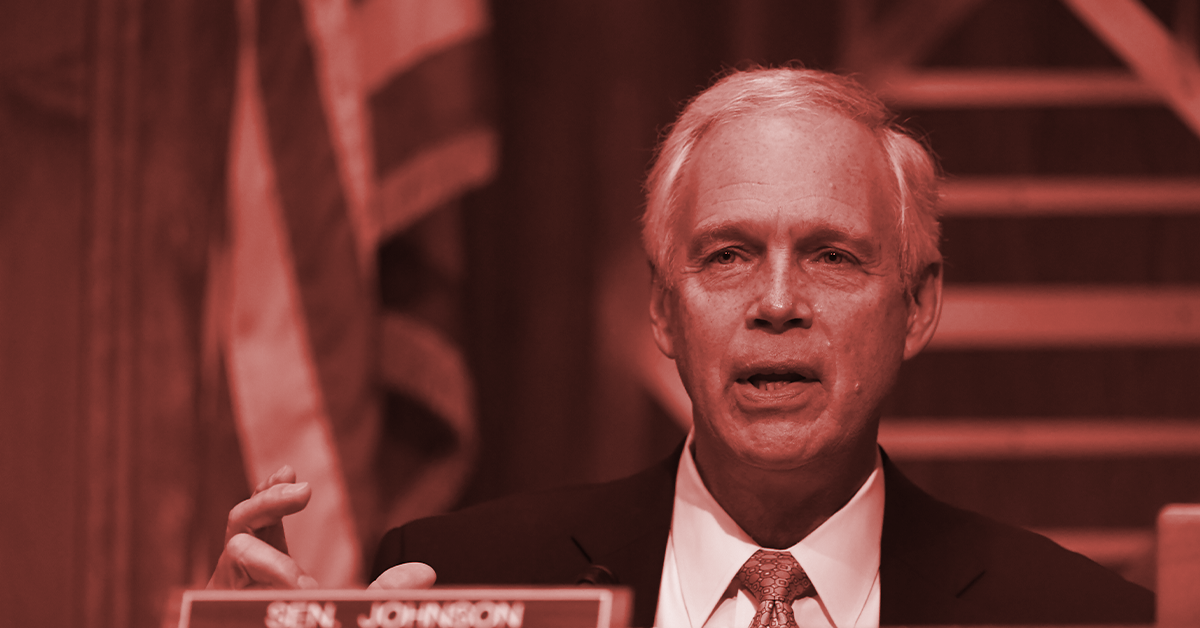

Ron Johnson still won’t come clean to Wisconsinites about how he paid just $2,105 in state income tax in 2017 — less than a jointly-filing married couple that made $40,000 — despite reporting a salary of at least $450,000. In a new interview with WIZM radio, Johnson continued his refusal to explain his reduced tax bill, dismissing the controversy (confirmed as accurate by Johnson’s own office) as a “distortive” “big lie” that is “really making a mountain out of a molehill.”

Johnson previously told HuffPost that the story was a “political hit job,” even though he hasn’t disputed any of the actual facts at hand. When the scandal broke, his office provided “few details” to the Associated Press and “refused to release his federal income tax returns.”

Last week, Johnson made headlines for falsely claiming that the richest 1% of Americans already pay “pretty close to a fair share” in taxes.

By Brad Williams | October 12th, 2021

Key Points:

- “Johnson was asked about reports that he paid just $2,105 in state income tax in 2017, despite earnings of at least $450,000. Johnson’s average state income tax payment over a 10-year span was $60,000 a year — or about 30 times more than he paid in 2017.”

- “Johnson gave some reasons for the figures but then called it a ‘big lie.’”

- “‘They cherry pick one year, where either I prepaid taxes the previous year or I had some reported losses or whatever,’ Johnson said. ‘This is really making a mountain out of a molehill. Completely distortive.’”“‘It’s just another one of the big lies….’”

Read the full WIZM report HERE.

###

Published: Oct 13, 2021 | Last Modified: Oct 18, 2021